|

Mara McDermott

Vice President of Federal Affairs

CAPG, the Voice of Accountable Physician Groups

1501 M Street NW Suite 640

Washington, DC 20005

June 13th, 2017

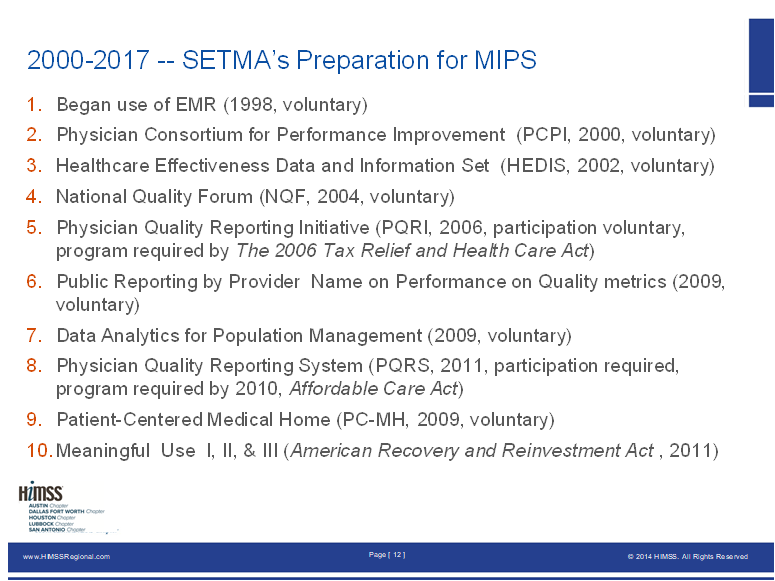

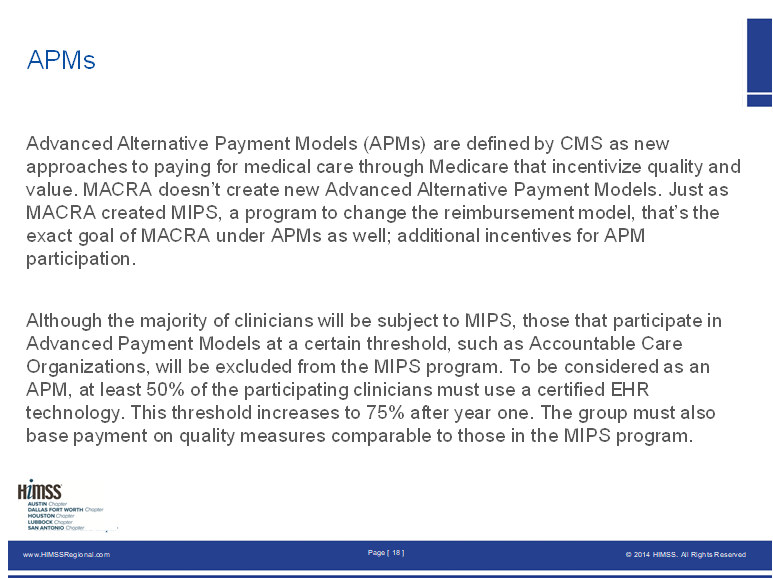

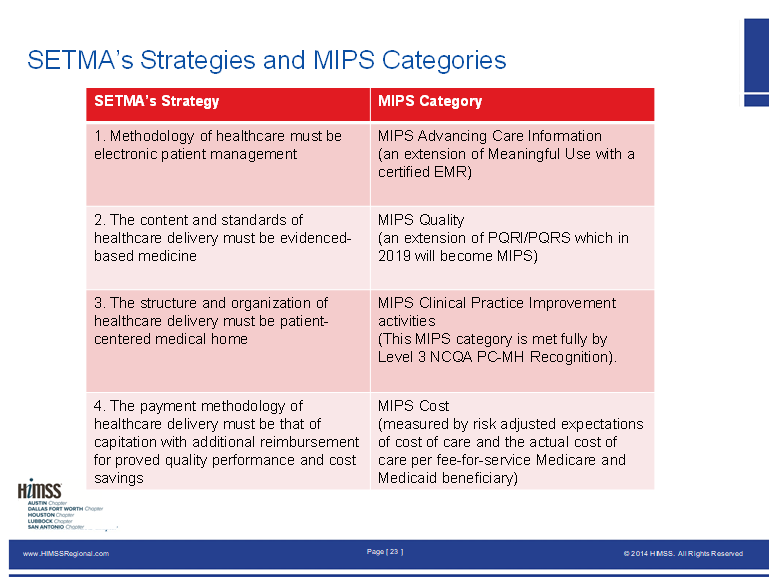

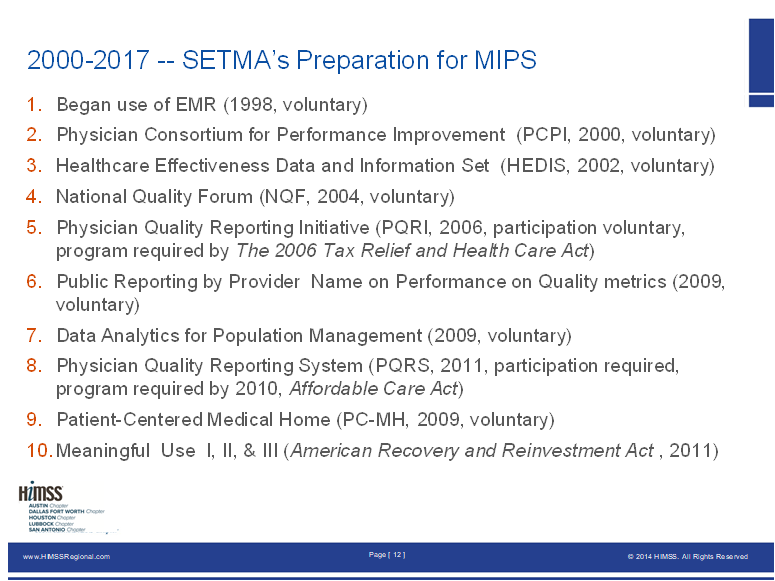

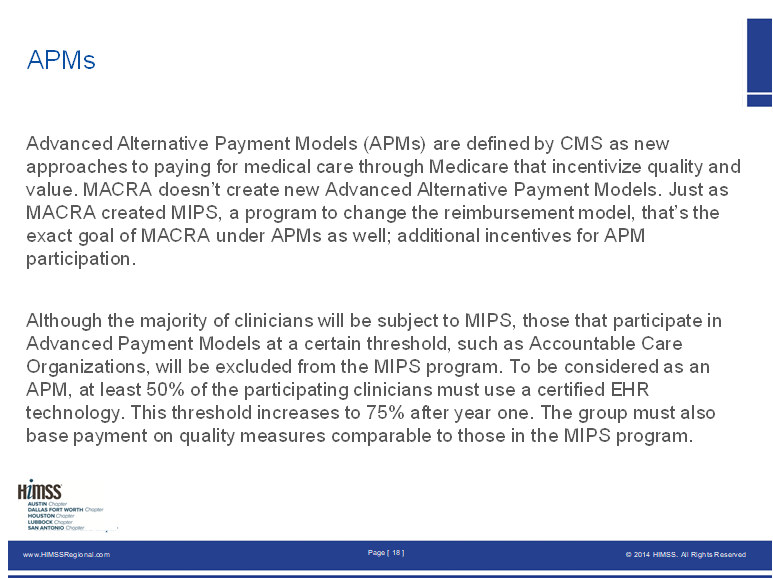

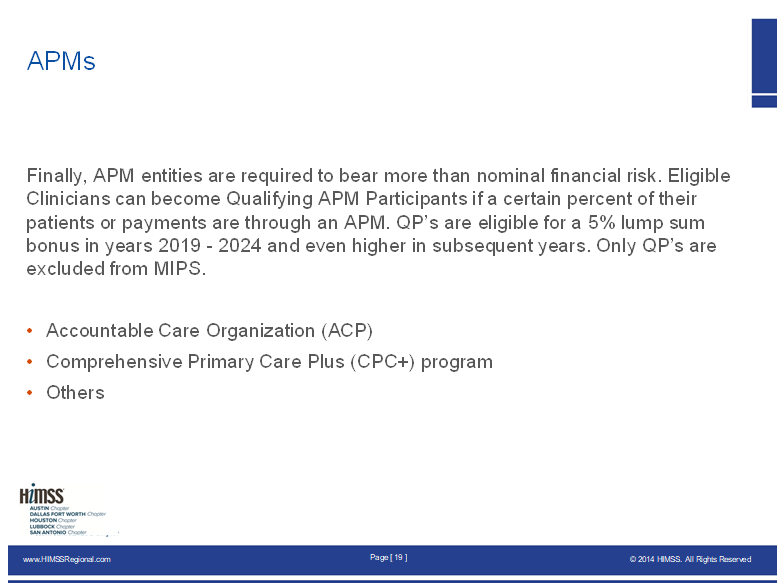

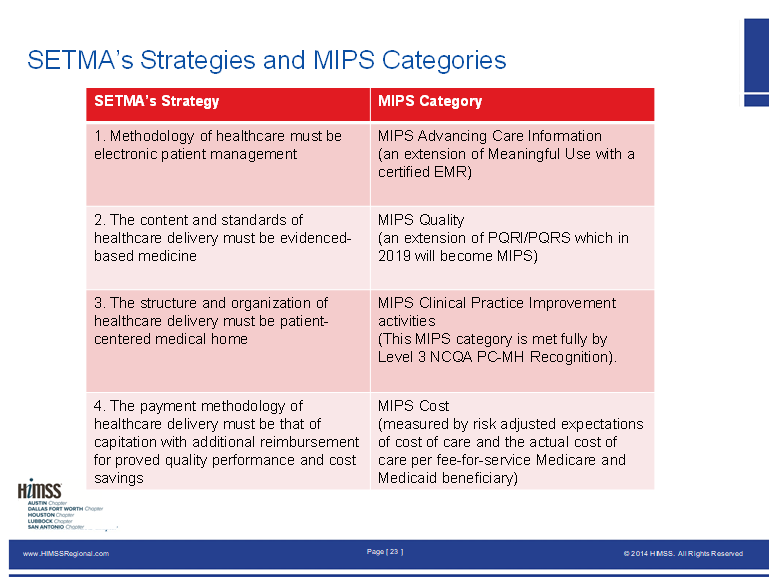

I am looking forward to our visit tomorrow. The following thoughts are preparatory to our call. I have copied four slides from my presentation to HIMSS in San Antonio three weeks ago. They address: 1. A Time line for SETMA’s preparation for MIPS which started in 1998; 2. The nature of an alternative payment model, two slides (APM); 3. A contrast between SETMA’s four standards and the four categories of MIPS. As is explained SETMA anticipated the four categories of MIPS, ten years before CMS published MIPS.

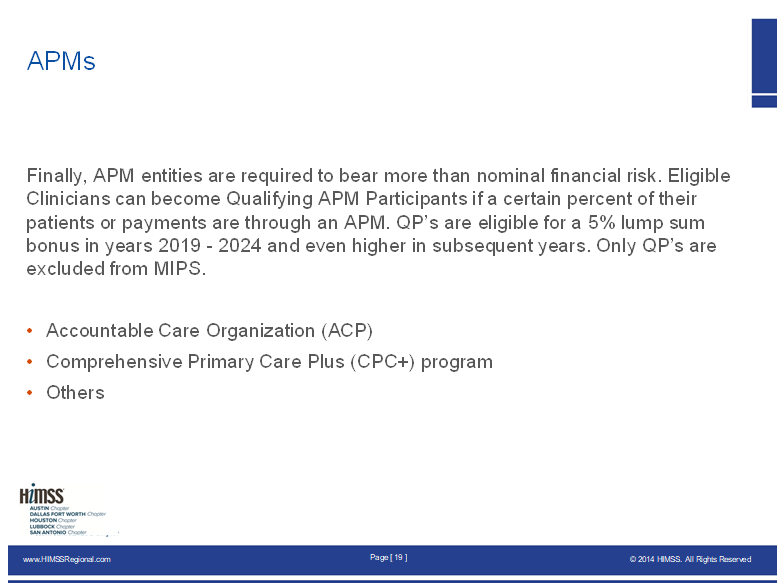

Apparently, APM must be designed to do three things: incentivize quality and value, and require healthcare providers to assume a significant risk, upside and down. It is clear that “value” addresses the cost of care in CMS’ lexicon as Value equals Quality divided by Cost.

Two elements of a practice’s Quality Resource and Utilization Report (QRUR) from CMS are “cost” and “quality.” A high quality, low cost QRUR will result a practice being in the right upper quadrant of CMS’ scatter graph which is ideal. (I have indicated that I would love to evaluate five or six practices which are in the lower left and quadrant (high cost, low quality) as I suspect they are not bad people but just not knowledgeable about the “new” system.

Why MA Should Qualify as an APM

With these three elements being the “qualifying requirements” for a practice model to be a APM, Medicare Advantage should qualify. MA models include quality and cost standards and controls and providers and health plans assume total risk for the care of a Medicare population.

However, there is one major difference which is the 500 pound gorilla in the room; in the MA plan there are no savings for CMS. In the APM, CMS realizes a significant reduction in cost. In the MA model, the cost reductions inure to the benefit of the health plan and providers, not to CMS. However, with the 4% annual reduction over the past seven years, CMS has realized a 28% reduction in their cost. On top of that the Affordable Care Act tax charged to MA plans has added a burden which has moved many MA-plan provider groups close to insolvency.

These cost savings to CMS should be adequate to qualify MA plans as APMs but I suspect that CMS is going to continue to argue that they are not qualified.

I look forward to discussing these issues with you. I have read a good deal of your materials. Very impressive.

James (Larry) Holly, M.D.

C.E.O. SETMA

www.jameslhollymd.com

Adjunct Professor

Family & Community Medicine

University of Texas Health San Antonio

The Joe R. and Teresa Lozano Long School of Medicine

Clinical Associate Professor

Department of Internal Medicine

School of Medicine

Texas A&M Health Science Center

|